Get a quote for medical insurance now

Health insurance beyond protection — enriched with never-before-seen rewards

Enrol your entire family at once to earn up to 99,5521 2 — enough to redeem four complimentary round-trip tickets to Seoul

Up to 6 months premium discount3 in the first 2 years

Coverage summary

Full coverage for various medical expenses with an annual benefit limit of up to HKD30 million and no lifetime benefit limit.

Issue age from 15 days old to 80 years old and guaranteed renewable up to age 100 of the Insured Person.

A global network of over 2 million medical providers to provide necessary medical support whenever you need it.

With pre-approval, you won’t need to pay a deposit to your medical providers or make a claim on medical expenses after discharge4, whether you’re in Hong Kong or overseas.

Add the Area of Cover Upgrade Guarantee to waive underwriting when you need to relocate, bringing you more flexibility and protection beyond the bounds of Hong Kong5.

Tailor your health plan by selecting your room type, area of cover and deductibles for your unique needs.

Benefit details

| Plan 1 | Plan 2 | Plan 3 | |

|---|---|---|---|

| Options for area of cover | Asia / Worldwide excluding the US / Worldwide | ||

| Room type (Hong Kong/Macau) | Standard ward | Semi-private Room | Standard private room |

| Room type (Outside Hong Kong / Macau) | Standard private room | ||

| Deductible | HKD0 / HKD15,000 / HKD30,000 | HKD0 / HKD15,000 / HKD30,000 / HKD60,000 | |

| Annual benefit limit (Applies to basic benefits) | HKD10 million | HKD20 million | HKD30 million |

| Lifetime benefit limit (Applies to basic benefits) | Unlimited | ||

| Key inpatient benefits | Fully cover6 | ||

The product information does not contain the full terms of the policy and the full terms can be found in the policy document.

Our partner

Cigna Healthcare

CIGNA Worldwide General Insurance Company Limited (Cigna Healthcare) is a global health service provider with a worldwide network of healthcare providers, clinics and facilities. This insurance plan is underwritten by Cigna Healthcare.

Cathay Pacific Airways Limited is an insurance agency (License No.: FA3522) authorised by Cigna Healthcare for the distribution of general insurance products in HKSAR.

Case Study

The following example is hypothetical and for illustrative purpose only. This case illustration is based on the assumption that no claims have been made under this plan prior to the incident described. The values presented may change over time, and no separate announcement will be made regarding such changes.

Calvin, enrolled in Cigna Cathay Premier Health Plan at 37 years old

Plan level: Worldwide excluding the US, Semi-Private and HKD15,000 deductible plan

1st year premium: HKD14,769 (non-smoker)

1st year basic miles rewards: up to 22,775, excluding limited time offer. Limited time offer varies from time to time. Please refer to the product offer page for up-to-date details.

Frequently asked questions

Help and support

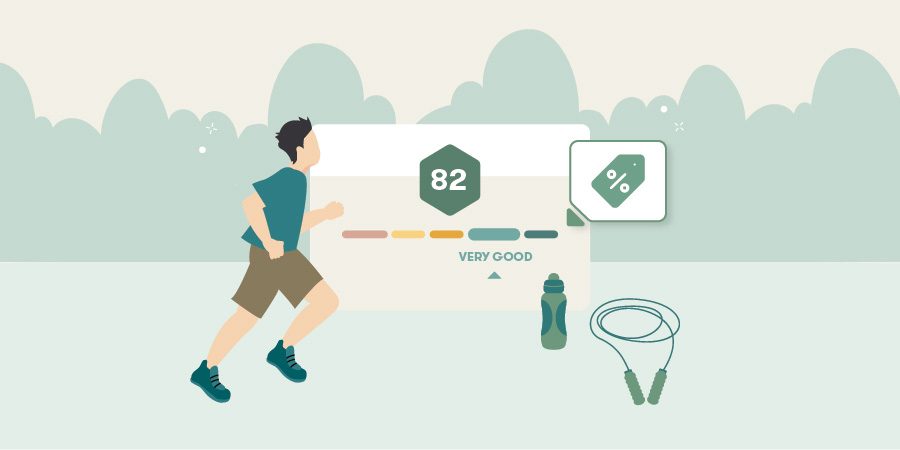

Earn miles by taking care of yourself

Earn miles for living well with the "Asia Miles by Cathay" app

Explore the wellness space in the "Asia Miles by Cathay" app, and let us help you lead a happier, more well-balanced lifestyle. Within 28 days of the inception of the designated policy, you will be rewarded up to 5,000 for completing at least one goal on elevated wellness journey.

Learn moreMore insurance products

1 Person insured is required to join and complete a goal in wellness journey within 28 days of policy inception date ("Required Goal"). For family policies, either the Policy Holder of any person insured(s) aged 18 or above on the policy inception date, must complete the required goal

2 Reward is calculated based on a family of 4, including 2 adults and 2 children

3 Applies to a family of four, with each eligible policy's maximum discount being 6 months in the first 2 years

4 Subject to providing proof that a specified event has or is expected to occur

5 Subject to prior approval, annual benefit limit, designated room type and area of cover

6 Please refer to the product brochure for detailed benefit limits

7 Cigna Care Manager Service is a value-added service and subject to terms and conditions. Medical support service and value-added services arranged by Care Manager are subject to individual cases

8 Value-added services are subject to individual cases

9 With pre-approval, you won’t need to pay a deposit to your medical providers or make a claim on medical expenses after discharge, whether you’re in Hong Kong or overseas. It is subject to prior approval, annual benefit limit, designated room type and area of cover

10 Premium is calculated based on a male, aged 27, selecting Dental Benefit plan 1 and Cancer Benefit plan 1

11 Premium is calculated based on the standard premium of a 20-24 years old insured, non-smoker, and selecting a ward room plan with HKD50,000 deductible

12 Premium is calculated based on a 18-year-old male, non-smoker, and selecting semi-private room with HKD50,000 deductible

.renditionimage.450.300.jpg)